When it comes to home appliance insurance in the United States, it is essential to know what the best options are for you. Home appliance insurance provides coverage for all of your household appliances in the event of a breakdown or accidental damage. It can be a great way to protect your valuable investments and avoid costly repairs or replacements. In this article, we will provide an overview of some of the best home appliance insurance companies and their plans available in the United States and explain how they work.

Table of Contents

What do home appliance insurance covers?

Home appliances are essential in our day-to-day lives. They make our lives easier and more comfortable, but they can also be a significant financial burden when they break down unexpectedly or need repairs. Fortunately, with home appliance insurance, you can have peace of mind knowing that you’re covered in case of any damages or mishaps.

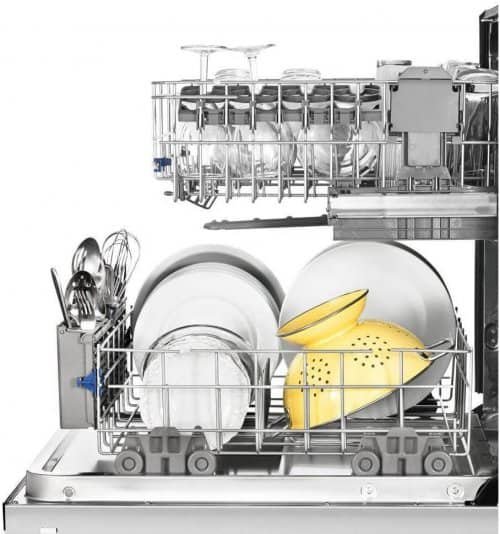

Home appliance insurance typically covers repair or replacement costs for major home appliances such as refrigerators, washing machines, dryers, stoves/ovens, dishwashers, and air conditioning units. This coverage includes mechanical failures due to manufacturer faults and accidental damages caused by everyday use. Additionally, some policies may cover the cost of labor and parts needed for repairs or replacements.

One important thing to note is that not all home appliance insurance policies are created equal. Some may have exclusions for certain types of appliances or repairs such as pre-existing issues or faulty installation.

What is the best home appliance insurance?

When it comes to finding the best home appliance insurance, there are a few factors to consider. First, you should look for a policy that covers all of your major appliances, such as refrigerators, washers and dryers, dishwashers, and air conditioners. You should also make sure the policy covers any repairs or replacements that may be necessary due to normal wear and tear. Additionally, you should look for a policy with a low deductible or no deductible at all so that you don’t have to pay out of pocket if something goes wrong. Finally, it’s important to find an insurance provider that offers reliable customer service so that you can get help quickly if there is ever an issue with your coverage.

Is Home Appliance Insurance worth it?

Yes it’s worth it, Home appliance insurance, also known as home warranty, is a type of protection that covers the cost of repairs or replacement of household appliances such as dishwashers, refrigerators, washing machines, and HVAC systems. Many people wonder if this insurance is worth the cost. While it may seem like an additional expense, there are several benefits to having home appliance insurance.

Firstly, home appliance insurance can save you money in the long run. If your appliances break down unexpectedly, repair and replacement costs can quickly add up. With a home warranty plan in place, you’ll be able to get repairs done or replace broken appliances without paying out-of-pocket expenses for costly repairs or replacements. Additionally, with a home warranty plan in place homeowners do not have to worry about finding reliable service providers because those services are covered by their warranty program.

Do i need Home Warranty Insurance?

If you are a homeowner, you might be wondering whether you need home warranty insurance. Home warranty insurance is a type of policy that covers the cost of repairs or replacements for household appliances and systems such as HVAC, plumbing, and electrical systems. But do you really need it? Here are some factors to consider when making this decision.

Firstly, think about the age and condition of your home’s appliances and systems. If they are old or in poor condition, they may be more likely to break down and require expensive repairs or replacements. In this case, having a home warranty could save you money in the long run. Secondly, consider your budget and how much risk you’re willing to take on. A home warranty can provide peace of mind knowing that unexpected repair costs will be covered, but it does come at an additional cost.

Cost of Home Warranty Insurance

Home warranty insurance is a service that provides coverage for the repair or replacement of major home appliances and systems. It typically covers items such as HVAC units, plumbing systems, electrical wiring, kitchen appliances and more. The cost of home warranty insurance varies depending on several factors.

Firstly, the age and condition of your home are significant determinants in calculating your home warranty insurance cost. An older house with outdated appliances will require more coverage than a newer property with modern features. Additionally, larger homes may need higher coverage levels than smaller homes due to the number of items requiring protection.

Secondly, different providers offer varying costs for their policies. Before signing up for any coverage plan, it’s essential to compare prices from various providers so you can get an idea of what you’re likely to pay.

Here is the list of home warranty companies which dominate the attention of customers with their services and commitment.

Best Home Warranty for Water Damage

Water damage is one of the most common and expensive issues that homeowners face, and it can be caused by numerous factors like flooding, pipe leaks, or sewer backups. Repairing water damage can cost thousands of dollars, which is why many homeowners opt for a home warranty that covers water damage. But with so many options available in the market, How do you Choose Best Home Warranty for Water Damage?

The first thing to consider when looking for a home warranty for water damage is coverage. The policy should cover not only sudden and accidental water damage but also gradual water damage that may result from plumbing defects or wear and tear over time. It should also include repairs or replacement of damaged pipes, valves, faucets, toilets, showers, bathtubs, drains and sewage lines as well as restoration services like drying out wet areas and mold remediation if necessary.

11 Affordable & Best Home Appliance Insurance Companies (Top 11 Home Warranty Companies)

Home appliances are expensive and there’s always the risk of something going wrong. Protecting your home appliances with insurance is a great way to guard against any damage or malfunction. Choosing the right company for home appliance insurance can be challenging, so to help, here is a list of the 11 best home warranty companies in the United States.

I will provide an overview of some of the top 10 best home appliance insurance companies and explain what factors to consider when selecting one. Although I am not affiliated with any of these companies, you can trust that my advice is unbiased. , my goal is for you to feel more informed about which company may be appropriate for your needs.

American Home Shield Appliance Insurance (Best Rated Home Appliance Insurance Company)

American Home Shield is the nation’s leading provider of home appliance insurance, offering comprehensive coverage and reliable service. With years of experience and a wide range of options, AHS has become a trusted name in the industry. Whether you need protection against malfunctioning appliances, accidental damage, or both, AHS provides an array of coverage plans to suit any budget. Customers benefit from 24/7 customer support, fast response times for repairs and replacements, discounts on additional services, and more.

What is an American Home Shield trade service fee?

American Home Shield is a home warranty company that provides repair and replacement services for major home systems and appliances. The company charges a trade service fee when customers request their services. This fee covers the cost of sending a technician to diagnose and repair the issue. It also covers the cost of any parts or labor needed to complete the job. The amount of the trade service fee depends on the type of repair being requested, as well as any additional fees associated with it. In some cases, American Home Shield may waive this fee if they determine that it is not necessary for the repair.

American Home Shield service fees range from $75, $100, or $125, This cost does not include sales tax where applicable.

Best Home Warranty for Plumbing

If you’re looking for the best home warranty for plumbing, look no further than America Home Shield. With over 50 years of experience in the home warranty industry, AHS has a proven track record of providing top-notch service to homeowners across the country. Their comprehensive plans cover everything from basic plumbing repairs to more complex issues like sewer line replacement.

One of the great things about an AHS plan is that they offer unlimited service calls with no additional fees or deductibles. That means you can call them as many times as you need without worrying about breaking your budget. And if they can’t fix your problem on the first visit, they’ll come back until it’s resolved – at no extra cost to you.

Another advantage of choosing America Home Shield for your plumbing needs is their network of licensed and insured contractors.

Choice Home Warranty (Reliable Home Warranty arranty Company)

Choice Home Warranty is a company that provides homeowners with protection against unexpected repair costs. For busy families and those who don’t have the time or money to deal with costly repairs, Choice Home Warranty offers peace of mind. This warranty ensures you won’t be faced with any out-of-pocket expenses should something go wrong in your home. With Choice Home Warranty, you can choose from many plans to find the one that meets your needs.

Choice Home Warranty Phone Number

A home warranty is a service contract that covers the cost of repairing or replacing your household appliances and systems when they break down. Choice Home Warranty is one of the leading providers in this industry, offering comprehensive coverage and exceptional customer service to homeowners across the country. If you are a Choice Home Warranty customer in need of assistance, you can easily reach their support team by calling their toll-free phone number.

The Choice Home Warranty phone number is available 24/7 for customers who need help with their coverage. Whether you’re experiencing an issue with your air conditioning system, plumbing, or electrical wiring, their team of knowledgeable representatives are equipped to handle any situation. When you call the Choice Home Warranty phone number, you’ll be greeted by a friendly representative who will guide you through the process and ensure that your problem is addressed promptly.

Choice Home Warranty Phone Number 1 888 531 5403

What is Choice Home Warranty Service Fee?

Choice Home Warranty Service Fee is a fee customers must pay in order to have a technician come to their home and assess or repair any covered items. The current service fee for Choice Home Warranty is $85, regardless of the type of claim being filed. This flat rate applies to any and all service requests, including small repairs as well as larger projects like appliance replacements, Choice Home Warranty service call fee may be lower depending on discounts available.

Not only does Choice Home Warranty provide excellent customer service by sending qualified technicians to assess and repair covered items, but they also offer an affordable fee that won’t break the bank. Customers can rest assured knowing that their $85 service fee will not increase depending on how complex the problem may be. Furthermore, this one-time payment covers both the assessment and repair of any eligible item up until it is restored back to working condition.

My Cinch Home Services

My Cinch Home Services provides comprehensive home appliance insurance for homeowners and renters. Cinch Home Services provides home appliance insurance to protect homeowners from the cost of repair and replacement of their major home appliances, including refrigerators, ovens, dishwashers, washing machines, and more. With My Cinch Home Services, you can be sure to protect your appliances from damage due to common mishaps such as electrical surges, power outages, and mechanical breakdowns. Whether you own a home or rent an apartment, Cinch Home Services has the perfect plan for you. With reliable coverage and competitive rates, Cinch offers superior protection at an affordable rate.

Priority Home Warranty Appliance Insurance

Priority Home Warranty is a valuable service that provides homeowners with the peace of mind that comes from having insurance for their home appliances. This type of home appliance insurance offers protection from costly repair and replacement bills when appliances break down due to normal wear and tear or other unexpected problems. With this coverage, homeowners can rest assured knowing that if an appliance becomes damaged or stops working, Priority Home Warranty will provide the necessary repairs or replacements at affordable rates.

Priority Home Warranty Phone Number

Priority Home Warranty is a trusted name in the home warranty industry, providing comprehensive coverage to homeowners across the United States. With years of experience and exceptional customer service, Priority Home Warranty has become a go-to choice for homeowners looking for peace of mind and protection against unexpected repair or replacement costs.

If you’re a Priority Home Warranty customer, it’s important to have their phone number readily available in case of an emergency or if you need assistance with your policy. The Priority Home Warranty phone number is 1-800-810-4966 and is available 24/7 to help with any questions or concerns you may have. Whether you need help filing a claim, updating your policy information, or simply want to learn more about your coverage options, their friendly and knowledgeable representatives are always standing by to assist.

Select Home Warranty

When it comes to protecting your home appliances, having the right insurance coverage can be a lifesaver. Select Home Warranty offers reliable and affordable home appliance insurance that helps you protect against expensive repairs and replacements. We look at what makes Select Home Warranty reviews with detailed Info, a great choice for homeowners who want to protect their investments. We’ll discuss how their plans work, what they cover, and how you can get the most out of your coverage.

Select Home Warranty Phone Number

One of the most important factors to consider when choosing a home warranty company is their customer service. After all, if you encounter an issue with your appliances or systems, you want to be able to reach out to someone quickly and efficiently. That’s where having a reliable phone number comes in.

At Select Home Warranty, we understand the importance of being readily available for our customers. That’s why we have a dedicated phone number that is accessible 24/7 for any questions or concerns you may have. Our team of knowledgeable representatives are ready and eager to assist you with anything from claims processing to general inquiries about our coverage plans.

By choosing Select Home Warranty as your provider, you can rest easy knowing that help is just a phone call away. We prioritize excellent customer service above all else and strive to exceed your expectations every step of the way.

Select Home Warranty Phone Number 1 833 815 624

What is Select Home Warranty Service Fee?

Select Home Warranty is a home protection plan that covers the repair or replacement of many major appliances and systems in your home. The service fee is the amount that you pay when you submit a claim for service. This fee will vary depending on the type of service you need but typically ranges from $75-$125, Depending on the home warranty provider and their network of qualified technicians, this can be a great way to save money on costly repairs or replacements.

In addition to the service fee, there may also be additional costs associated with the repair or replacement of an item. These costs are typically covered by Select Home Warranty, but in some cases, you may be responsible for a portion of them. For example, if the repair requires special parts or materials, you may be required to pay for those items up front and then receive reimbursement from Select Home Warranty.

Select Home Warranty offers several different plans so it’s important to read through all of your options carefully before making a decision.

The Home Service Club

The Home Service Club is a great way to make sure your home appliances are protected from breakdown and repair costs. With Home Appliance Insurance, you can rest assured knowing that if something happens to one of your essential household items, it will be taken care of quickly and efficiently. Whether you have an oven, refrigerator, or washing machine, the Home Service Club protects them all.

Liberty Home Guard

Liberty Home Guard is a premier home appliance insurance policy that provides protection from the unexpected cost of repairs and replacements. For homeowners, having a dependable and reliable home appliance insurance policy can be invaluable. Liberty Home Guard offers coverage both inside and outside of the home, ensuring your appliances are protected no matter where they are. With this policy, you can rest assured that your appliances will be covered from wear and tear, mechanical breakdowns, and even power surges.

Liberty Home Guard Phone Number

When it comes to protecting your home, Liberty Home Guard is one of the best providers out there. They offer top-of-the-line security systems and monitoring services to ensure that your property is safe at all times. But what happens when you need assistance or have questions about your service? That’s where the Liberty Home Guard phone number comes in.

By calling their dedicated customer service line, you can get help with any issues you may be experiencing with your security system. Whether it’s a technical problem or simply a question about how to use certain features, the knowledgeable representatives at Liberty Home Guard are always ready to assist you.

The company also offers emergency services for situations that require immediate attention, such as a break-in or fire. In these cases, calling the Liberty Home Guard phone number can quickly connect you with the appropriate authorities and get help on its way to your home right away.

Liberty Home Guard Phone Number 1 833 544 8273

First American Home Warranty

Today, more and more homeowners are considering home appliance insurance to protect their major investments. This can be a smart move, given the high cost of repairs and replacements. An increasingly popular option is First American Home Warranty, which offers affordable coverage to safeguard furniture, appliances, and systems in your home. In this article, we’ll explore what First American Home Warranty entails, how it works, and why it might be the right choice for you.

First American Home Warranty Phone Number

Owning a home can be an exciting and fulfilling experience. However, with the joys of homeownership come the potential for costly and unexpected repairs. That’s where First American Home Warranty comes in – offering comprehensive coverage for your home’s major appliances and systems.

If you’re searching for the First American Home Warranty phone number, look no further. You can easily reach their customer service team by dialing 1-800-992-3400. Their knowledgeable representatives are available to answer any questions you may have about coverage options, claims processes, or general inquiries.

With over three decades of industry experience, First American Home Warranty has built a reputation as a trusted provider of home warranty services nationwide. By choosing them as your partner in protecting your home from unexpected repair costs, you can enjoy peace of mind knowing that they’ve got you covered 24/7.

Americas First Choice Home Club

America’s First Choice Home Club is a leading provider of home appliance insurance. Their policy covers all major household appliances, such as refrigerators, stoves, washers, and dryers. The company provides comprehensive coverage for any mechanical or electrical breakdowns that may occur in your appliances due to normal wear and tear. With their flexible coverage options and customer-friendly policies, America’s First Choice Home Club has become a go-to source for reliable protection against unexpected appliance repairs.

HomeServe

HomeServe is a home appliance insurance provider that offers customers protection for their appliances and systems. It provides customers with access to emergency repair services, as well as discounts on replacement parts and equipment. HomeServe’s insurance plans are designed to help homeowners cover the expense of unexpected repairs and breakdowns. With HomeServe’s coverage, homeowners can save money on costly repairs and replace the faulty equipment with ease.

HomeServe Phone Number

If you are a homeowner and always worried about unexpected plumbing, electrical or heating breakdowns, then HomeServe is here to help. But what if you need to contact them urgently? That’s where the HomeServe phone number comes in handy.

By calling the HomeServe phone number, you can quickly get in touch with their customer service team who are available 24/7 to assist with your home emergencies. The trained professionals will listen carefully to your problem and provide you with immediate solutions so that you can get back to enjoying your home.

Additionally, not only does the HomeServe phone number offer emergency assistance but they also have a range of services available such as annual boiler servicing, gas safety checks and appliance repairs which can be booked over the phone. So why wait until an emergency arises?

HomeServe Phone Number 1 855 336 2465

Priority Home Warranty

Priority Home Warranty offers peace of mind to homeowners looking to protect their investments. With home appliance insurance, Priority Home Warranty can help you save thousands of dollars in potential repairs and replacements. No matter the age or condition of your appliances, Priority Home Warranty provides a comprehensive plan that covers all major components and systems in your home. You can choose from different tiers of coverage to ensure that your budget is respected and you get the coverage that’s right for you.

Pros and Cons of Home Appliance Insurance

Home appliance insurance has become an increasingly popular way to protect your investments in large kitchen and laundry appliances. Whether you’re buying a washing machine, refrigerator, dishwasher, or other home appliance, the cost of repairs and replacements can be significant. With an appliance insurance policy, some of these costs may be covered if something goes wrong.

Let’s discuss the pros and cons of having this type of coverage for your home.

Pros of Home Appliance Insurance:

- Home appliance insurance provides coverage for unexpected repairs or replacements.

- It helps to spread the cost of repair or replacement of appliances over time.

- Service contracts often come with additional benefits such as discounts from appliance suppliers and free technical assistance.

- Home appliance insurance can be tailored to the specific needs of homeowners and their appliances.

- Insurance policies help protect the home from financial loss due to the failure of major appliances like HVAC systems, refrigerators, and dishwashers.

Cons of Home Appliance Insurance:

- Home appliance insurance is an additional expense that may not be necessary for all households.

- Insurance plans may not cover certain types of repairs or replacements which could result in higher out-of-pocket costs for homeowners.

- Most of the time you might not use it (Unclaimed).

- The cost of an insurance plan could exceed potential repair or replacement costs over time, making it a less valuable investment than some other options available to homeowners.

Home appliance insurance is an additional expense that may not be necessary for all households.

Insurance plans may not cover certain types of repairs or replacements which could result in higher out-of-pocket costs for homeowners.

Most of the time you might not use it (Unclaimed).

The cost of an insurance plan could exceed potential repair or replacement costs over time, making it a less valuable investment than some other options available to homeowners like

Types of Coverage:

Home appliance insurance in the United States can provide homeowners with peace of mind knowing that their appliances are protected. Whether it’s a refrigerator, stovetop, washing machine, or dishwasher, these policies can help offset repair costs associated with breakdowns and malfunctions.

Types of Home Appliance Insurance:

- Coverage for Damage or Loss

- Coverage for Accidental Breakdown

- Optional Additions to Coverage

Different types of home appliance insurance coverages are available to meet various needs. Some policies may include basic coverage for repairs due to normal wear and tear or mechanical breakdowns. Other policies may provide additional benefits such as coverage for accidental damage and loss due to power outages or natural disasters. Furthermore, some policies may even offer coverage for rental fees if the insured item has to be replaced during repairs.

To ensure consumers get the most out of their home appliance policy, it’s important to compare plans from different providers and read all terms carefully before purchasing a plan.

Coverage for Damage or Loss:

Home appliance insurance can provide peace of mind for homeowners in the event of damage or loss. With home appliance insurance, policyholders are able to protect themselves against all sorts of unexpected repair costs and replacement fees that may arise. Homeowners can choose from a variety of coverage plans that will cover all major appliances, such as refrigerators, dishwashers, ovens, and more. Depending on the plan selected, policyholders may also be eligible to receive additional services such as 24/7 emergency repair assistance and scheduled maintenance check-ups.

Home appliance insurance is designed to save homeowners time and money when it comes to dealing with damages or losses related to their appliances. Policyholders can make claims at any time during the year when an appliance needs repairs or replacement due to natural disasters, accidental breakages, or other forms of wear and tear.

Coverage for Accidental Breakdown:

With coverage for accidental breakdowns, people can save themselves from the expense and hassle of repairing or replacing malfunctioning appliances.

Home appliance insurance policies offer a range of coverage levels that vary depending on the type of appliance and its age. Some policies provide coverage for accidental damages caused by electrical surges, mechanical failure, wear-and-tear, and other issues that may not be covered by most home insurance plans. Additionally, some insurers offer additional levels of protection such as extended repair warranties and loaner appliances if repairs are required.

By investing in a home appliance insurance plan with coverage for accidental breakdowns, homeowners can rest assured knowing they will be protected should any unexpected issues arise with their household appliances.

Optional Additions to Coverage:

Home appliance insurance is a great way to protect your investment in appliances and protect yourself from costly repairs or replacements. Appliances can be expensive, so having home appliance insurance can help make sure that you are covered if something happens.

Optional additions to basic home appliance coverage may include coverage for refrigerators, freezers, washers and dryers, dishwashers, ovens, microwaves, and more. You may also be able to add on additional coverage such as accidental damage protection or extended repair times in the event of an emergency. Furthermore, it is possible to increase the amount of coverage for certain items if desired.

By adding these optional additions to your home appliance insurance package you can ensure that you are well-protected against potential damages or breakdowns. Make sure to research all the different options available so that you get the best value for money when choosing a policy!

Costs of Home Appliance Insurance:

The cost of home appliance insurance varies depending on several factors, such as the type of coverage you choose and the size and value of your appliances. For example, basic coverage might cover only power surges while more comprehensive coverage could offer protection for breakdowns caused by normal wear and tear. Different insurers may provide different levels of coverage at different prices, so it’s important to shop around to find the best deal for your individual needs.

Home appliance insurance can be a great way to protect your home and its valuable contents from unexpected damage or breakdown. But before signing up for an insurance policy, it is important to understand its approximate costs.

On average, home appliance insurance costs between $30-$50 per month depending on the coverage limits and types of appliances being insured. This cost can go up if more expensive items such as air conditioners and refrigerators are added to the policy. Additionally, some companies may offer discounts for those who bundle other types of insurance policies together such as homeowners’ or renters’ insurance. Therefore, shopping around for rates across different insurers is highly recommended to help find the best deal possible.

Benefits of Home Appliance Insurance:

Home appliance insurance is a great way to ensure your appliances remain in functioning order. From washers and dryers to refrigerators, dishwashers, and ovens, home appliance insurance can help you save money on repairs or replacements in the event of a malfunction. Home appliance insurance policies are available from both independent providers and home warranty companies.

Some benefits of having home appliance insurance include peace of mind that repairs or replacements will be covered if something goes wrong with your appliances. Additionally, some policies cover routine maintenance and inspections so you don’t have to worry about costly repairs or breakdowns due to lack of maintenance. You also won’t have to pay for diagnostic fees as these are typically included in the policy coverage.

Cost of Coverage:

Home appliance insurance is an important component of ensuring that your home appliances are properly protected from accidental damage or breakdown. The cost of coverage for home appliances can vary depending on the type, age, and brand name of the appliance.

The average cost for coverage will depend on a few different factors. The size and complexity of the appliance, as well as its age and condition, will determine what kind of policy you need to purchase and how much it will cost you annually. If you have multiple appliances in your home, you may be able to find a package plan that offers discounts based on the number of items that are insured under one policy.

When shopping around for coverage, it’s important to take into consideration all these factors so that you get a plan that meets your needs without breaking your budget.

How to Compare Home Appliance Insurance Policies?

Comparing home appliance insurance policies can be a daunting task, but it is essential for homeowners to ensure they make the best choice. Home appliance insurance typically covers repairs and replacements of certain appliances due to accidental damage or mechanical breakdowns, so it’s important for homeowners to compare policies in order to determine which policy will provide the most coverage and offer the best value.

When comparing home appliance insurance policies, it’s important to first understand what type of coverage each policy provides. Not all plans cover the same types of appliances or provide coverages such as accidental damage, so you will need to evaluate each plan carefully. It’s also important that you consider any additional fees associated with a policy such as deductibles and premium costs.

What to Look for in Home Appliance Insurance?

Shopping for a home appliance insurance policy can be overwhelming. With so many different companies offering varying coverage options, it can be difficult to determine which one is best for you and your family. Knowing what to look out for when shopping around will help make the process easier.

When considering a home appliance insurance plan, think about how much coverage you need and how much you are willing to pay in premiums. Be sure to check whether the policy covers accidental damage or normal wear and tear. Additionally, ask if there is an excess fee as this could add additional expenses on top of any repairs that are needed. Also, make note of any additional benefits that come with the policy such as extended warranties or discounted repair services.

What does home appliance insurance cover?

When it comes to home appliance insurance, there is a great deal of coverage available. Home appliance insurance policies can help you cover any repairs or replacements that are necessary for appliances in your home. Depending on the policy and the provider, home appliance insurance plans can include coverage for both systems and appliances.

Systems plans typically cover items such as air conditioning, heating systems, and electrical systems. Appliances plans usually offer coverage for a variety of common household appliances, like dishwashers, refrigerators, and even washers and dryers. Some policies may even provide additional benefits such as reimbursements or discounts on parts or repairs that aren’t covered by the policy itself.

Home appliance insurance provides peace-of-mind protection in case of emergency repairs or replacements due to the age or wear-and-tear of major appliances in your home.

Is Home Appliance Insurance worth it?

The value of home appliance insurance depends on several factors, including the cost of the appliances, their age, and the likelihood of needing repairs or replacements. Here are some points to consider when deciding if home appliance insurance is worth it for you:

- Cost of the appliances: If you have expensive appliances that would be costly to replace or repair, home appliance insurance may be worth it. For example, if you have a high-end refrigerator or a smart TV, the cost of repairs or replacement could be significant.

- Age of the appliances: If your appliances are relatively new and still under warranty, home appliance insurance may not be necessary. Many appliances come with manufacturer warranties that cover repairs or replacements for a certain period. However, if your appliances are older and no longer under warranty, insurance may be a good option to protect against unexpected repairs.

- Likelihood of repairs: Consider the likelihood of your appliances needing repairs or replacements. If you have a history of appliances breaking down or you live in an area with frequent power outages, insurance may be worth it for peace of mind.

- Cost of the insurance: Home appliance insurance can vary in cost, and it’s important to weigh the cost of the insurance against the potential cost of repairs or replacements. Make sure to read the policy carefully to understand what is covered and any exclusions or limitations.

Overall, home appliance insurance can provide peace of mind and protect against unexpected repair costs. However, it’s important to weigh the cost of the insurance against the value of your appliances and the likelihood of needing repairs.

How much does home appliance insurance cost?

Home appliance insurance is a great way to protect yourself against the costs of repairing or replacing damaged appliances. It can give you peace of mind knowing that you’re covered in case something goes wrong with your dishwasher, microwave, refrigerator, washer, dryer, and other essential household appliances. But how much does home appliance insurance cost?

The cost of home appliance insurance varies depending on the coverage offered and which appliances are included in the policy. Generally speaking, policies cover all major household appliances, including refrigerators and freezers. Some policies may also include coverage for service call fees – this fee is paid when a service technician comes to your house to inspect a broken system. Additionally, homeowners may be able to get discounts if they bundle their home appliance insurance with other types of coverage like homeowners or auto insurance.

Enrollment fees for home appliance insurance vary depending on the provider you choose and the amount of coverage you need. Generally, these fees can range anywhere from $100 to over $600 per year. Some companies may also require a one-time fee in addition to their monthly or annual rate, so be sure to check with your potential provider before signing up for any policy.

In addition to enrollment fees, some providers may also charge an additional deductible each time you file a claim for service or replacement of an appliance covered by the policy.

The average cancellation fee for customers who cancel after 30 days of coverage is $75. Mostly it ranges between $20–$99 depending on the company, This fee helps cover administrative costs associated with canceling a policy and may not be refundable if cancelled after that period. Cancellation fees may vary by provider so it’s important to review all details before committing to any one plan or company.

Is home appliance insurance worth it?

Home appliance insurance can be a worthwhile investment for many homeowners. It can provide peace of mind knowing that you’re covered in the event of an unexpected breakdown or malfunction. The cost of repairs or replacements can be expensive, and having insurance may help to offset some of those costs.

The main benefit of home appliance insurance is that it may cover the cost of repairs or replacements due to normal wear and tear, as well as accidental damage. This coverage can extend beyond just major appliances such as refrigerators and washers/dryers, but also include smaller items like microwaves and vacuum cleaners. Depending on your policy, you may even be able to get coverage for parts like hoses and cords that are necessary for proper functioning.

Ultimately, whether or not home appliance insurance is worth it will depend on your individual situation. Consider the value of your appliances, their age, how often they’re used, and the cost of any potential repairs before making a decision.

What is home appliance insurance?

Home appliance insurance is a type of coverage that helps to protect homeowners from the financial burden of repairing or replacing damaged home appliances. This type of insurance typically covers major household appliances, such as refrigerators, stoves, dishwashers, air conditioners, and washing machines.

Home appliance insurance can help to provide peace of mind for homeowners who are worried about the cost of repairing or replacing a broken appliance. It can also help to reduce the financial burden associated with unexpected repairs or replacements. In some cases, the insurance company may even cover the cost of delivery and installation of a new appliance.

Home appliance insurance is often included in a homeowner’s policy, but it can also be purchased as an add-on coverage option. It’s important to read through the terms and conditions of any policy carefully before making a purchase in order to understand what types of appliances are covered and what kind of protection is offered.

What is the difference between home insurance and home Appliance insurance?

Home insurance is a type of property insurance that provides financial protection against damages to an individual’s home. It covers both the structure of the home, as well as the personal belongings inside it. Home insurance typically includes coverage for things like fire, weather damage, theft, and other types of losses.

Home appliance insurance is a specialized form of home insurance that provides additional coverage for appliances and electronics in the home. It helps protect homeowners from losses due to mechanical breakdowns or electrical failures of these items. This type of coverage is often available as an add-on to standard home insurance policies and can be used to cover items such as refrigerators, washing machines, televisions, and computers.

Overall, home insurance provides broad protection for a person’s house and possessions within it, while home appliance insurance offers more specific coverage for certain types of items in the home.

How much does home appliance insurance cost?

Home appliance insurance typically costs between $3 and $10 per month, depending on the coverage you select. The cost of your policy will depend on the value of your appliances, the number of items covered, and the deductible you choose. It’s important to shop around for the best deal when selecting a home appliance insurance policy.

When choosing a policy, it’s important to consider which types of appliances you want to cover. Some policies may cover only major appliances such as refrigerators and dishwashers, while others may also cover small kitchen appliances like microwaves and coffee makers. You should also look into what type of repair or replacement services are offered by each policy; some policies may offer more comprehensive coverage than others.

Finally, be sure to read through the fine print of any policy before signing up. Make sure you understand what is covered and what is not, as well as any exclusions or limitations that might apply.

What are the limitations and exclusions of home appliance insurance?

Home appliance insurance typically covers the repair or replacement of home appliances, such as washers and dryers, refrigerators, and dishwashers. However, there are certain limitations and exclusions that may apply.

First, most policies will not cover damage caused by normal wear and tear, misuse, or intentional damage. Additionally, some companies may exclude coverage for certain types of appliances such as air conditioners or hot tubs. Also, many policies do not cover the cost of labor to repair the appliance; instead, they will only cover the cost of parts and materials needed for the repair.

Finally, most home appliance insurance policies have a maximum coverage limit for each appliance. This means that if an expensive item needs to be replaced due to a covered event (such as a power surge), the policyholder may need to pay out-of-pocket for any costs over the coverage limit.

What does home appliance insurance cover?

Home appliance insurance covers repairs and replacements for a variety of household appliances. This type of insurance usually covers major appliances such as ovens, refrigerators, washers and dryers, dishwashers, and other large items. It may also cover smaller items like microwaves, vacuums, and toasters. Depending on the policy, it may also cover certain types of damage to the appliances caused by power surges or other accidents.

Home appliance insurance can be a great way to save money in the long run. Instead of having to pay for expensive repairs out of pocket when something breaks down, you can rely on your insurance policy to help cover the costs. Additionally, this type of coverage can provide peace of mind knowing that if something happens to your appliances you have protection in place.

Overall home appliance insurance is a great option for anyone looking for an extra layer of protection for their important household items.

How does home appliance insurance work?

Home appliance insurance is a type of policy that covers the cost of repairs or replacements for major household appliances. This type of insurance typically covers refrigerators, washers and dryers, stoves, dishwashers, and other large home appliances.

When you purchase a home appliance insurance policy, you will pay a monthly premium to have coverage in case your appliances break down or need to be replaced due to normal wear and tear. The amount of coverage and the deductible may vary depending on the policy you purchase. Most policies will cover the cost of parts and labor for repairs, as well as the cost of replacing an appliance if it cannot be repaired.

It’s important to read through the details of any home appliance insurance policy before purchasing it so that you understand what is covered and what is not. It’s also important to make sure that any policy you purchase is from a reputable insurer with good customer service ratings.

What is the best home appliance insurance?

The best home appliance insurance will depend on your individual needs and budget. When looking for an insurance policy, it is important to consider the coverage offered, the cost of premiums, and any additional features that may be included.

One option for home appliance insurance is a home warranty plan. These plans cover major appliances and systems in your home such as refrigerators, ovens, air conditioners, water heaters, and more. They can provide peace of mind knowing that you are covered if something breaks down or needs repair.

Another option is a homeowners insurance policy which may provide coverage for certain types of damage to appliances caused by events such as fire or theft. It is important to read the fine print of any policy carefully to make sure it covers what you need it to. Be sure to compare different policies so you can find one that meets your needs at the best price.

11 Best Home Appliance Insurance Companies

American Home Shield

Choice Home Warranty

Cinch Home Services

Priority Home Warranty

Select Home Warranty

The Home Service Club

Liberty Home Guard

First American Home Warranty

Americas First Choice Home Club

HomeServe

Priority Home Warranty

How good are home appliance insurance?

Home appliance insurance can be a great way to protect your investments in appliances. It can provide coverage for repair or replacement costs, as well as other benefits such as emergency service and extended warranties.

The cost of home appliance insurance will depend on the type of coverage you want and the value of the items you are insuring. Generally, it is more cost-effective to insure multiple items together, rather than each item individually. This can help you save money while still protecting your investment.

In general, home appliance insurance is a good option for those who want to protect their investments in appliances. It provides peace of mind that if something were to happen to an appliance, it would be covered by the policy. Before purchasing a policy, make sure to compare different options and read through the terms and conditions carefully so you know exactly what is covered.

Do I need insurance for appliances?

Yes, you should consider getting insurance for your appliances. Appliance insurance can help cover the cost of repairs or replacements if something goes wrong with your appliance. Depending on the type of policy you purchase, it may also cover costs associated with accidental damage, power surges, and other unexpected events.

When shopping for appliance insurance, make sure to read the fine print carefully to understand exactly what is covered and what isn’t. You’ll also want to compare different policies to find one that offers the best coverage at an affordable price. Additionally, look for a provider who offers reliable customer service in case you need assistance filing a claim or have questions about your policy.

Having appliance insurance can give you peace of mind knowing that your investment is protected from any unexpected issues that may arise. It’s important to do your research so you can find a policy that fits your needs and budget.

What is the best home warranty service?

The best home warranty service depends on your individual needs. While there are many companies offering home warranties, some of the top-rated ones include American Home Shield, Choice Home Warranty, and TotalProtect.

American Home Shield is one of the oldest and largest home warranty companies in the United States. They offer comprehensive coverage for a wide range of systems and appliances, including air conditioning systems, plumbing systems, and electrical systems. They also have 24/7 customer service with live agents available to answer any questions you may have.

Choice Home Warranty offers similar coverage to American Home Shield but at a lower cost. Their plans cover major systems and appliances such as heating and cooling systems, water heaters, refrigerators, dishwashers, washers, and dryers. They also provide additional coverage for items like swimming pools or spas.

TotalProtect is another popular choice for homeowners looking for a home warranty service.

Is it smart to pay for home warranty?

Whether or not it is smart to pay for a home warranty depends on your individual situation. If you are a first-time homeowner, or if you have an older home that needs more frequent repairs, then a home warranty may be a good option. A home warranty can provide peace of mind and protection against costly repairs due to mechanical breakdowns of major appliances and systems.

On the other hand, if you’re in a newer home with fewer repairs needed, then the cost of the warranty may outweigh any benefit you receive from it. It’s important to do your research and understand what types of coverage are included in the plan before signing up for one. Make sure that it will cover any potential issues that could arise in your specific situation.

Ultimately, whether or not a home warranty is right for you depends on your individual circumstances. Consider all factors carefully before making a decision.

Who is the number 1 home warranty company in USA?

The number one home warranty company in the USA is American Home Shield. Founded in 1971, American Home Shield is the oldest and largest home warranty provider in the country.

They provide comprehensive coverage for major systems and appliances, including HVAC, plumbing, electrical, and more. Their plans are customizable to meet your specific needs, and they offer a variety of service options that make it easy to get help when you need it.

Additionally, they have an A+ rating from the Better Business Bureau and have received multiple awards for their customer service excellence. With over 45 years of experience in the industry and millions of customers served nationwide, American Home Shield is a trusted name in home warranties.

Are appliance insurance worth it?

It depends on your individual situation. Appliance insurance can help cover the cost of repairs and replacements for appliances that break down, so it may be worth it if you are concerned about the cost of repairs or replacements for your appliances. On the other hand, if you have a newer appliance with a good warranty, appliance insurance may not be necessary.

Another factor to consider is how much coverage you need. Some policies only cover certain types of appliances or provide limited coverage, while others offer more comprehensive coverage. You should read the policy carefully to make sure it fits your needs before making a decision.

Ultimately, appliance insurance can help protect against unexpected costs, but it is important to weigh the pros and cons carefully before making a decision. Consider your budget and the value of your appliances when deciding if appliance insurance is worth it for you.

What is appliance protection plan?

An appliance protection plan is a service contract that covers the repair and/or replacement of major household appliances such as refrigerators, washers, dryers, microwaves, and ovens. The plan typically includes parts and labor costs associated with repairing or replacing the appliance in the event of a breakdown due to normal wear and tear. Depending on the provider, some plans may even cover accidental damage caused by power surges or other external factors.

Appliance protection plans can be a great way to save money in the long run since they cover repairs that would otherwise have to be paid out-of-pocket. They also provide peace of mind knowing that if something goes wrong with an appliance, it will be taken care of without any additional cost. It’s important to read through all details of the plan before signing up so you know exactly what is covered and what isn’t.

Define Best Home Appliance Insurance:

Home appliances are essential for daily living, but when they break down unexpectedly, it can cause a major inconvenience. While some appliances come with manufacturer warranties, they usually have a limited lifespan and may not cover everything that could go wrong. This is where home appliance insurance comes in handy.

The best home appliance insurance policies provide comprehensive coverage for all your household equipment against damage caused by mechanical failure or accidental damage. They offer peace of mind knowing that you won’t have to pay out of pocket for costly repairs or replacements. Additionally, some policies even cover the cost of hiring a professional technician to carry out the repairs.

When looking for the best home appliance insurance policy, it’s important to consider factors such as the level of coverage, customer service quality and affordability. You want an insurer that offers flexible payment options and has a reasonable deductible amount.

What is the best appliance extended warranty company?

The best appliance extended warranty company depends on the individual needs of the consumer. Before selecting a company, it’s important to consider the coverage offered and the cost of the plan.

SquareTrade is one of the most popular extended warranty companies for appliances. They offer flexible coverage plans with low deductibles and 24/7 customer support. Their plans also include coverage for accidental damage, meaning if an appliance breaks due to an accident, SquareTrade will cover it.

Another great option is American Home Shield. They offer comprehensive plans that cover repairs or replacements for all major home appliances, including refrigerators, washers and dryers, stoves, dishwashers and more. Plus, their plans come with no service fees or hidden costs. Ultimately, whichever company you choose should depend on your budget and what type of coverage you need for your appliances.

What the difference between home insurance and home appliance insurance?

Home insurance and home appliance insurance are two different types of coverage. Home insurance is designed to protect the structure of a home as well as its contents, including furniture and personal possessions. It may also cover liability for anyone who visits or works at the residence.

Home appliance insurance covers damages and repairs for specific appliances such as refrigerators, televisions, washers, dryers and other large items – it does not cover everyday wear and tear on these appliances. The type of coverage depends on the policy purchased, with some policies covering parts only while others provide full replacement costs.

When selecting a policy, homeowners should consider what they need covered in order to choose the right coverage plan

Is plumbing covered by home warranty?

Home warranty plans are becoming increasingly popular among homeowners in the USA. These plans offer a sense of security and peace of mind when it comes to repairing or replacing essential home appliances. However, many people are unsure whether plumbing is covered by their home warranty plan. Here, we will discuss what is typically included in a standard home warranty plan and whether plumbing falls into this category.

Most home warranty plans cover basic household appliances such as refrigerators, ovens, dishwashers, and washing machines. They also cover major systems such as electrical, heating/cooling, and plumbing. That being said, the level of coverage can vary depending on the specific plan you have chosen. Some more comprehensive plans may even include coverage for items such as pool equipment or septic tanks.

Conclusion:

Home appliance insurance can be a beneficial investment for any homeowner, but is it worth the cost? Home appliance insurance provides homeowners with coverage when their appliances malfunction and need repairs or replacement. This coverage can save homeowners time and money while ensuring they have access to the best services available.

The advantages of home appliance insurance are numerous. It covers the costs of emergency repairs, replacements, and even labor charges for qualified technicians. It also helps protect against more costly problems like fire, flooding, or other natural disasters that could damage an appliance beyond repair. The coverage provided by a home appliance policy also shields owners from potential liabilities from damage caused by faulty appliances in their homes.

Overall, home appliance insurance is an important investment for any homeowner looking to protect their investments from potential damages caused by accidents, weather-related events, or faulty equipment.

12 thoughts on “11 Affordable Home Appliance Insurance United States”

Comments are closed.